The U.S. military is used to being on the front lines of conflicts around the world. But the latest battle they find themselves involved in is probably one they would never have expected: the fight between beer, wine, and spirits.

The ongoing struggle among the categories for market share spread to military bases after a recent pilot test of beer and wine sales at commissaries (the equivalent of grocery stores on the bases). It was the first time commissaries were allowed to sell alcoholic beverages in the system’s history, following the decision in April 2018 by the Department of Defense (DOD), which oversees the commissary system, to allow the test.

But the DOD’s decision to exclude spirits from the test has opened a new front in the ongoing, often fierce, competition for market share between the alcohol categories.

Don’t miss the latest drinks industry news and insights. Sign up for our award-winning newsletters and get insider intel, resources, and trends delivered to your inbox every week.

The 90-day pilot test took place in 12 selected commissaries starting on July 23, 2018; it wrapped up in late October. Pleased with the results, the DOD decided to continue sales of beer and wine at the 12 test stores while it evaluates whether to expand sales to the rest of the system’s 226 stores in the U.S. and abroad. As of December 8, some $394,315 worth of beer and wine were sold in the 12 commissaries—$190,574 in beer, and $203,741 in wine—according to Lieutenant Colonel Carla Gleason, a Pentagon spokeswoman.

The spirits industry had been hoping that a test of spirits sales at the commissaries might follow. But the DOD has decided it will not move ahead with a pilot test for spirits. “The department has evaluated the sale of alcoholic beverages in commissaries,” says Gleason, “and stands by its original decision to limit the sales to a small selection of beers and wines.”

Excluding Spirits from Commissaries

David Ozgo, the senior vice president for economic and strategic analysis for the Distilled Spirits Council, says the trade group had been pushing for the inclusion of spirits. “We have shared our concerns with DOD staff and have provided them with data and information on the benefits of adding distilled spirits along with beer and wine on commissary shelves,” he says. “Spirits, wine, and beer all compete for the same drinking occasions. By discriminating against spirits, the DOD is picking marketplace winners and losers and trying to dictate consumer preferences … Excluding spirits puts us at a competitive disadvantage.”

Gleason, however, says the DOD was simply trying to emulate the practice of grocery stores when it made the decision not to carry spirits. “Commissary stores are intended to be similar to commercial grocery stores and may sell merchandise similar to that sold in commercial grocery stores,” she says. “Beer and wine are commonly available in commercial grocery stores, and the availability of these products in commissary stores provides our customers with the convenience that they customarily experience in commercial grocery stores. Distilled spirits were excluded from this authorization as they are not commonly sold in commercial grocery stores across the U.S.”

Ozgo disagrees. “We believe that, consistent with 28 states that allow spirits to be sold in grocery stores, spirits should be sold in commissaries,” he says. “The modern consumer demands convenience and choices. Spirits have been gaining market share from beer and wine for almost 20 years now. The current generation of men and women in the military, among all ranks, enjoy spirits, and the commissary system should make shopping as easy and convenient as possible.”

Ozgo adds that the omitting of spirits from sales at commissaries sends a negative message. “Our policy in the states is that if beer and wine are allowed to [be sold] in a venue, then spirits should be allowed to [be sold] as well,” he says. “We do not advocate equal treatment just for commercial reasons. When spirits are treated differently from beer and wine, it sends the message that beer and wine are “soft” alcohol, or nonintoxicating. This is a dangerous message for our military men and women, and it is why all branches of the military teach standard drink equivalency as part of their alcohol education.”

Actually, spirits, along with beer and wine, have been available for years on military bases, but through other channels, like the base exchange, which is similar to a department store. Sales of beer, wine, and spirits at the exchanges will continue unchanged under the new commissary policy. But the exchanges also now serve as the direct-store delivery vendor for the commissaries’ beer and wine products and will also provide pricing and category management. They will charge the commissary for the actual cost of the merchandise, along with any additional costs they directly incur for providing these products to the commissary and a reasonable allowance to offset the expected loss of earnings from migrated sales (sales the exchanges may now lose to the commissaries).

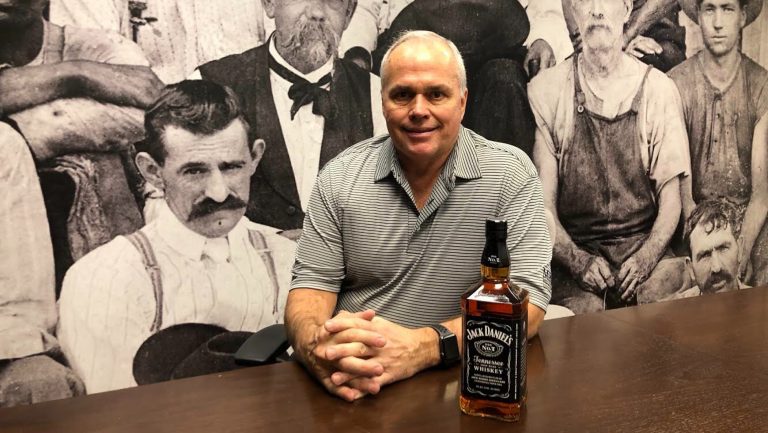

Alcohol sales make up approximately 9 percent of overall sales at army base exchanges. The top three brands for each category are Bud Light, Miller Lite, and Coors Light for beer; Apothic Red, Stella Rosa, and Roscato for wine; and Hennessy, Crown Royal, and Jack Daniel’s for spirits, according to Chris Ward, the senior public affairs manager for the Army & Air Force Exchange Service.

At the 17 marine base exchanges in the U.S. and Japan, which are under their own, separate system (as are the coast guard and the navy), alcohol products brought in $53.9 million in 2017. Beer is the top seller, followed by spirits, then wine. The best-selling beer brands are Budweiser, Miller, and Coors. Bourbon is the top-selling spirit category overall, with the top brands by volume being Jack Daniel’s and Jim Beam. Barefoot is the best-selling brand of wine, according to Bryan Driver, a spokesperson for the marines and the plans, policy, and analysis director for business and support services for Headquarters Marine Corps.

Gauging the Potential Benefits

Ozgo points out that the move to offer beer and wine at the commissaries comes as commissary sales have declined sharply. Sales at the stores fell by nearly 23 percent between 2012 and 2018, according to Gleason. “The commissary system has been losing business to off-base/post alternatives for years,” says Ozgo, “and is trying to modernize its business practices.”

Gleason says the decision to expand commissary sales to beer and wine wasn’t based primarily on revenue generation. “It was also intended to provide customers a shopping experience similar to commercial grocery stores without displacing primary grocery items,” she says. “Although there are many aspects of commissaries that mimic commercial retail grocery stores, commissaries are not specifically designed to compete with the civilian market. Ultimately, the commissary’s mission is to provide a savings benefit for military members and their families. The entirety of the commissary’s customer base is persons who have been designated as authorized patrons.”

The alcohol sold in commissaries is not taxed, she says, as commissaries are a legislated nonpay benefit serving the military, and the products sold in them are not subject to local or state taxes. “The intent was to offer only a limited assortment of beers and wines,” Gleason says, “and DeCA [Defense Commissary Agency, the DOD agency that directly manages the commissaries] will refrain from engaging in marketing practices that would glamorize the sale or use of alcoholic beverages.”

Joe Bollinger, the director of military-transportation for Brown-Forman, the spirits and wine company based in Louisville, Kentucky, says the U.S. military channel is a top-10 customer for his company, with about 90 percent of Brown-Forman’s product sales in the channel being done at bases in the U.S. and 10 percent overseas. The spirits category is growing about 4 to 5 percent in the military channel, he says, with the Brown-Forman portfolio growing about 4 percent in the channel as well.

DOD policy, Bollinger points out, is that the shelf price on military bases for spirits brands should be 5 percent below the everyday shelf price of Walmart, Total Wine, and similar off-base competitors. “The military patrons are brand loyal and look for value when shopping on base,” he says. “We work with military spirits buyers to implement in-store promotions such as tastings, engraving bottles, et cetera, to help build loyalty with our brands.”

About 5.4 million military households shop at the commissaries, according to the latest statistics, resulting in some $4.9 billion in total annual sales. “We provide a tangible value through the benefit of savings, which benefits our patrons financially,” reads DeCA’s values statement. “We are the link that supports our patrons for products and services that are familiar, valued, and represent their choices.”

Some experts are worried that if sales continue to fall, the base commissary system may not survive. So it’s possible that the rest of the alcohol industry, not just spirits, may lose this revenue option. For now though, wine and beer brands will be awaiting the DOD’s decision on whether they will soon be sold in the rest of the commissary system’s hundreds of stores in the U.S. and overseas. It’s a decision that could help support the commissary system for years to come.

Dispatch

Sign up for our award-winning newsletter

Don’t miss the latest drinks industry news and insights—delivered to your inbox every week.

Andrew Kaplan is a freelance writer based in New York City. He was managing editor of Beverage World magazine for 14 years and has worked for a variety of other food and beverage-related publications, and also newspapers. Follow him on Twitter at @andrewkap.